Case study – The importance of flexibility on Council Tax premium

Our advice service assisted an owner struggling with an inherited family home which had been empty for 7 years. The owner intended to renovate and live in the property, and contacted the advice service distressed as the council tax premium was a financial burden. Paying the premium was reducing the budget for renovation work and was hampering progress with the property being brought back into use. The owner also faced several barriers, including delays in dealing with the estate, waiting for planning permission, issues sourcing contractors and rising cost of materials.

The home was in a state of disrepair and needed considerable work before it could be lived in. It didn’t have any insulation, it was damp, the roof leaked, there was no kitchen, the bathroom had asbestos and it required rewiring. Renovating the home was a huge task for the owner and carrying out the work would take at least 2 years.

SEHAS was able to offer support and talk through options with the owner.

A referral was made to the local EHO who assisted in securing discretion for a year. This gave the owner reduced costs, and time to bring the home up to habitable standard.

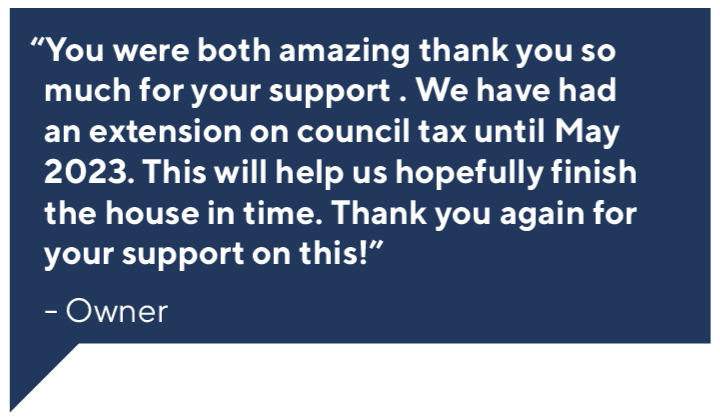

The owner was exceptionally grateful for our assistance, and has been keeping us updated with progress. Without SEHAS’ help, this owner would still be struggling with the premium and a reduced budget which may have delayed the home being brought back into use. The advice provided by SEHAS, coupled with the local Council’s policy on discretion has helped this owner and it is anticipated that work will complete by summer 2023.